The folders on this page contain everything from returns and instructions to payment vouchers for both income tax programs and business tax programs. That's the beauty of Free File Fillable Forms! Free Federal return tax preparation and e-file.Welcome to the Taxation and Revenue Department’s Forms & Publications page. Important: If you have a question about a form while preparing your Free File Fillable Forms return, always refer to the " Instructions For This Form" which is displayed as a button for all the forms at lower part of the screen.

If you elect direct deposit for getting your refund, then enter and check your bank account information on lines 76b, Routing Number, 76c, type of account, and 76d, Account Number (See instructions under Direct Deposit to view a sample check).Check the box, Full-year coverage, on line 61 if you have qualifying health care coverage for all of 2015.

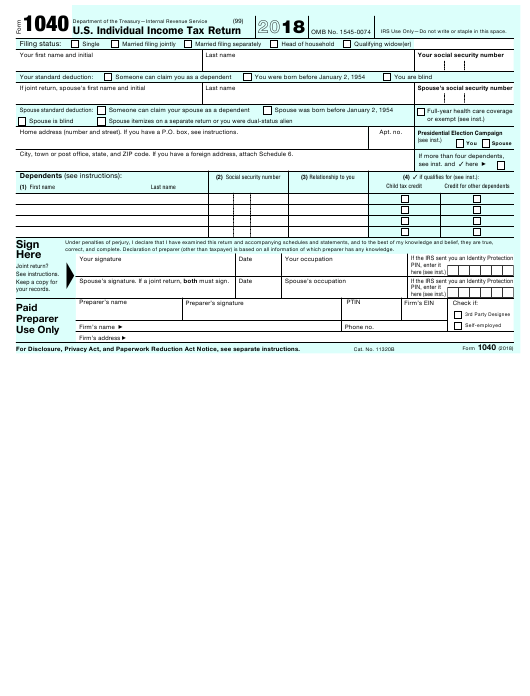

To add up your itemized deduction amount on line 29 of the Schedule A and transfer that total amount from line 29 to line 40 of the Form 1040.

To add up your itemized deduction amount on line 29 of the Schedule A and transfer that total amount from line 29 to line 40 of the Form 1040.

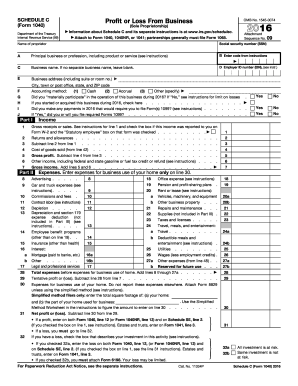

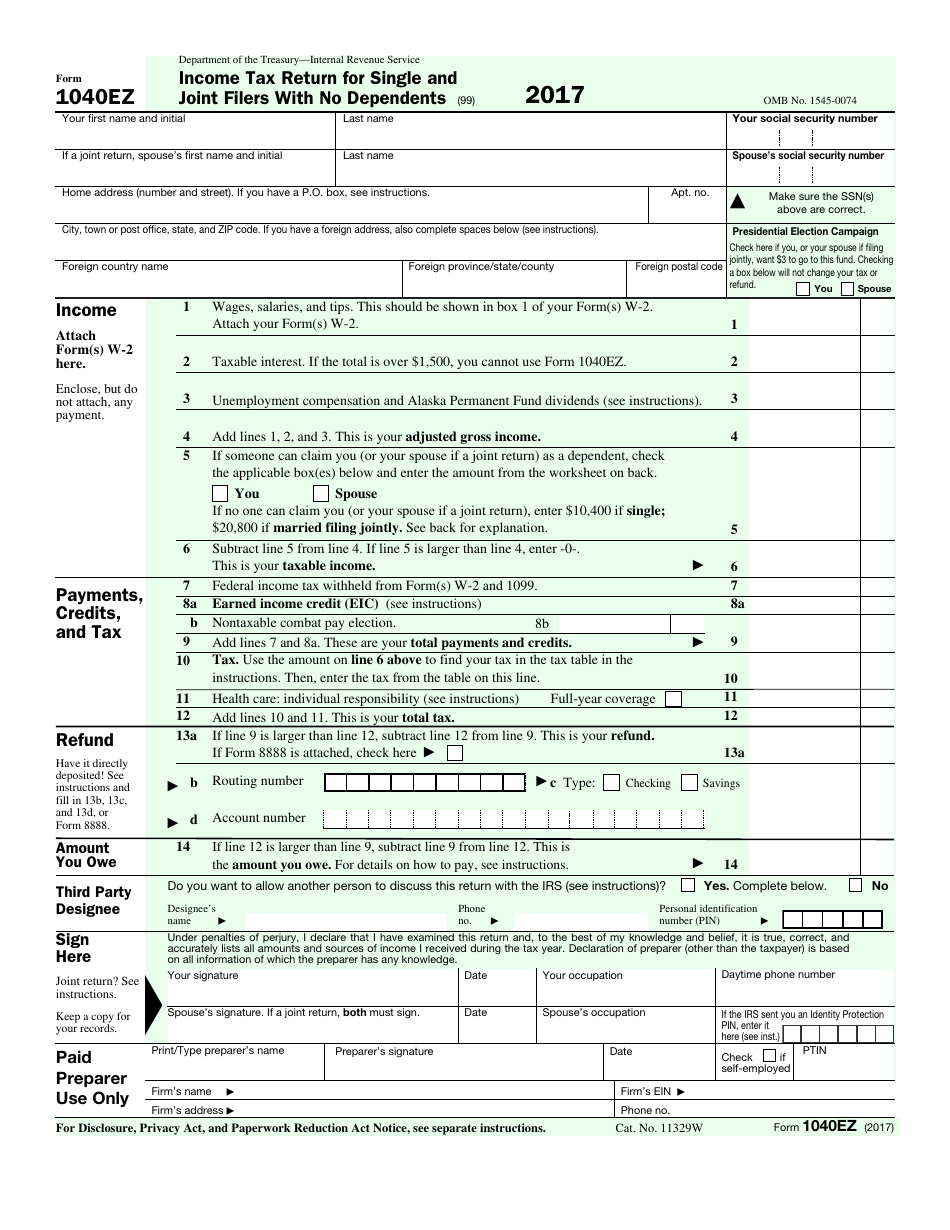

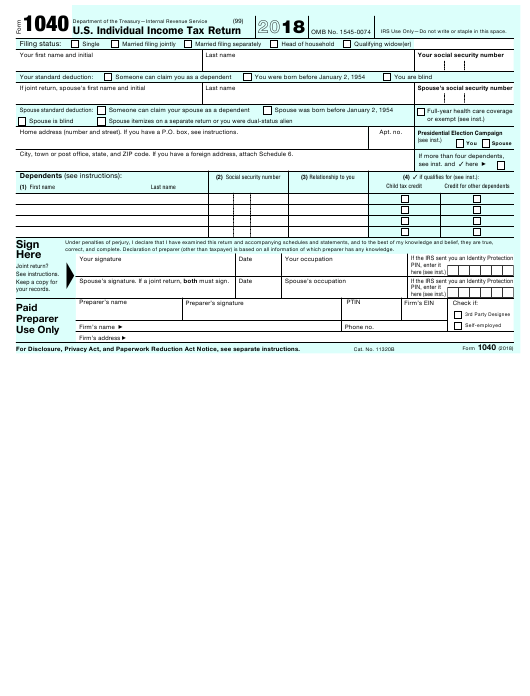

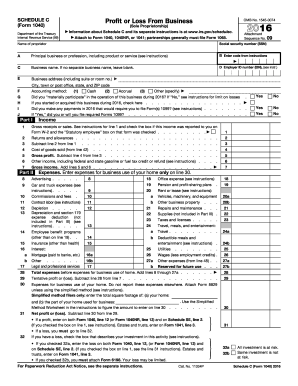

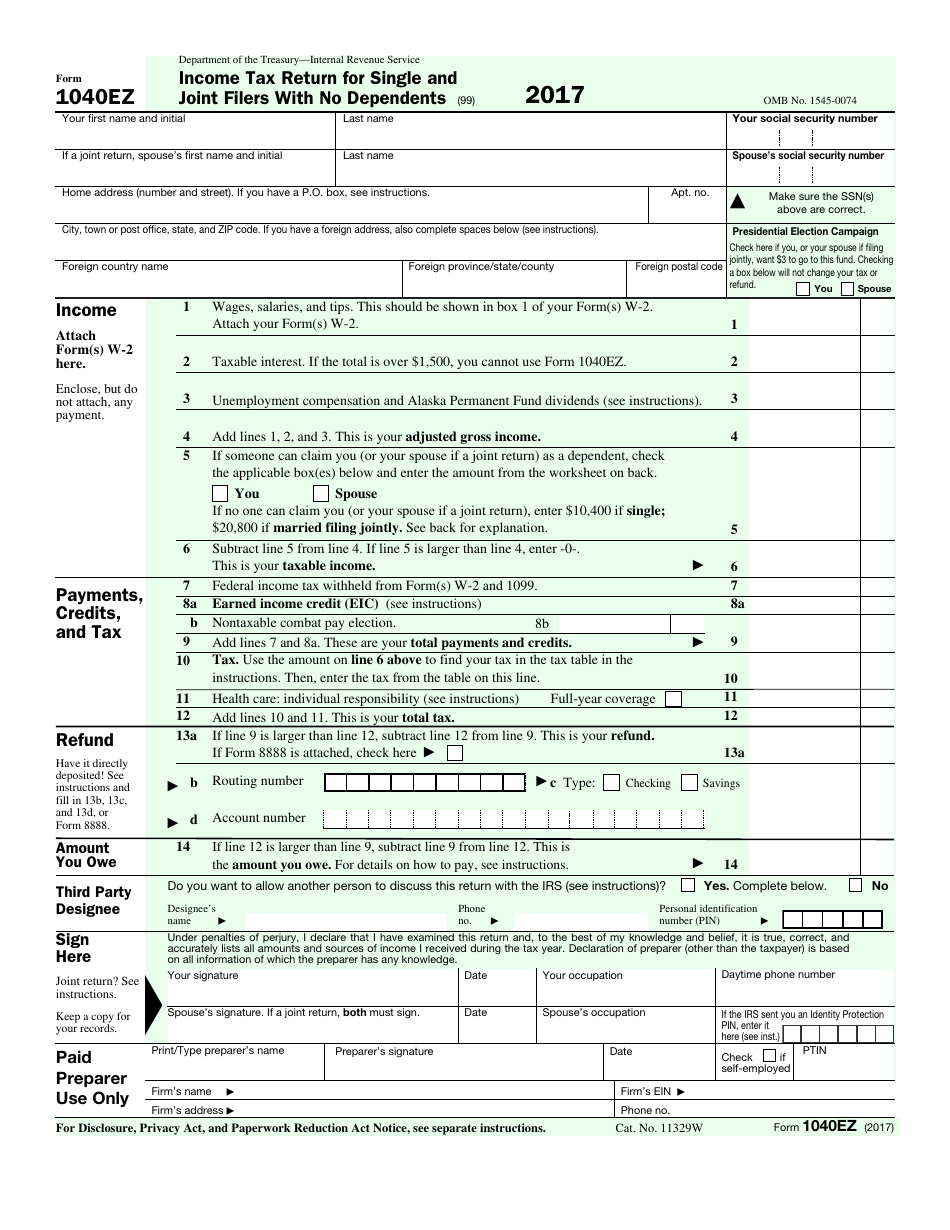

You report income from sale of a property or you need to report stock sales (Schedule D & Form 8949). You report self-employment income (Schedule C) or. You claim Schedule A itemized deductions. Your taxable income is $100,000 or more. If you elect direct deposit for getting your refund, then enter and check your bank account information on lines 48b, Routing Number, 48c type of account, and 48d, Account Number (See instructions under Direct Deposit to view a sample check). Check the box, Full-year coverage, on line 38 if you have qualifying health care coverage for all of 2015. Don’t forget to enter your Tax amount on line 28. You claim adjustments to income for IRA contributions and student loan interest. If you elect direct deposit for getting your refund, then enter and check your bank account information on lines 13b, Routing Number, 13c, type of account, and 13d Account Number (See instructions under Direct Deposit to view a sample check). Check the box, Full-year coverage, on line 11 if you have qualifying health care coverage for all of 2015. Don’t forget to enter your Tax amount on line 10. You are not claiming any tax credits other than the Earned Income Credit. You do not have any adjustments to income. You are claiming the standard deduction only (Can't itemize using Schedule A). You and your spouse are under 65 years old at the end of 2015. Your filing status is single or married filing jointly. Your taxable income is less than $100,000.

0 kommentar(er)

0 kommentar(er)